Understand Your Current Financial Position

COVID-19 presents a significant threat not only to human health but also to business. However, businesses have an array of actions they could implement to manage through the COVID-19 pandemic. These actions could ensure its longevity and place it in the best possible position to take advantage of the recovery.

The more you understand your current financial position, the better choices you will make when during and moving forward after the pandemic. To be able to make the best possible decisions in a difficult environment, you need access to the most up-to-date information on the financial position of your business.

PREPARE & MAINTAIN UP-TO-DATE FINANCIAL STATEMENTS

In this unique environment, to make the best possible decisions for your business you must access the most current information on your business’s financial position. By bringing your financial statements up-to-date and keeping them up-to-date, businesses can determine their health and continue to make informed decisions throughout the pandemic.

Up-to-date financials also allow businesses to see their current cash position. A business’s cash position refers specifically to its level of cash compared to its pending expenses and liabilities. It will allow you to see the cash you have deposited in a bank and determining what assets can be sold quickly, at a particular moment in time.

ANALYSE THE BUSINESS’S FINANCIAL HEALTH

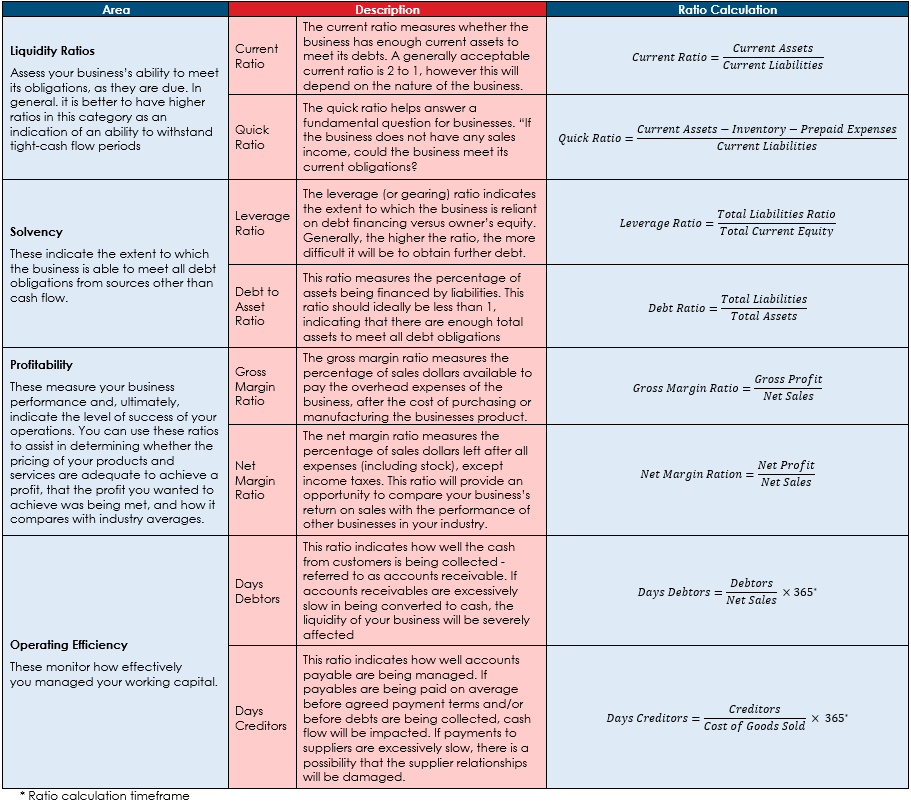

Reviewing financial statements allows you to undertake a detailed analysis to evaluate your business’s overall financial health and to make a determination of the likelihood of continuing as a viable business. There are a number of financial ratios to assess liquidity, solvency, profitability and operating efficiency. Your accountant will be able to assist with the analysis. See ratio table below.

IDENTIFY YOUR KEY PERFORMANCE INDICATORS (KPI’S)

Key performance indicators will quickly tell you how your business is performing and continually measure business performance. Selecting the right KPI’s will depend on your industry and which part of the business you are looking to track.

Several KPI’s will quickly tell you how your business is tracking. They could include the value of daily sales, cash balance of the business, debtors’ balance, and value of orders and bookings.

To use KPI’s to the best of their ability, create a graph showing these key indicators and update it daily.

SET UP A CASH FLOW STATEMENT

A cash flow statement will track all the money flowing in and out of your business. The statement measures how well a business manages its cash position, meaning how well the company generates cash to pay its debt obligations and fund its operating expenses. In these challenging times, it can help you identify a reduction in your cash flow early. A business can also use a cash flow statement to predict future cash flow, which helps with matters of budgeting.

If you would like to discuss this please contact our office.

RATIO TABLE